Background/Challenge

Over the past 4 years, closely adhering to the CMB’s objective of building a "Light-operation Bank with the strategy of developing business agility driven by technology agility”, ETU has cooperated closely with the retail banking team for 80+ projects since 2014.

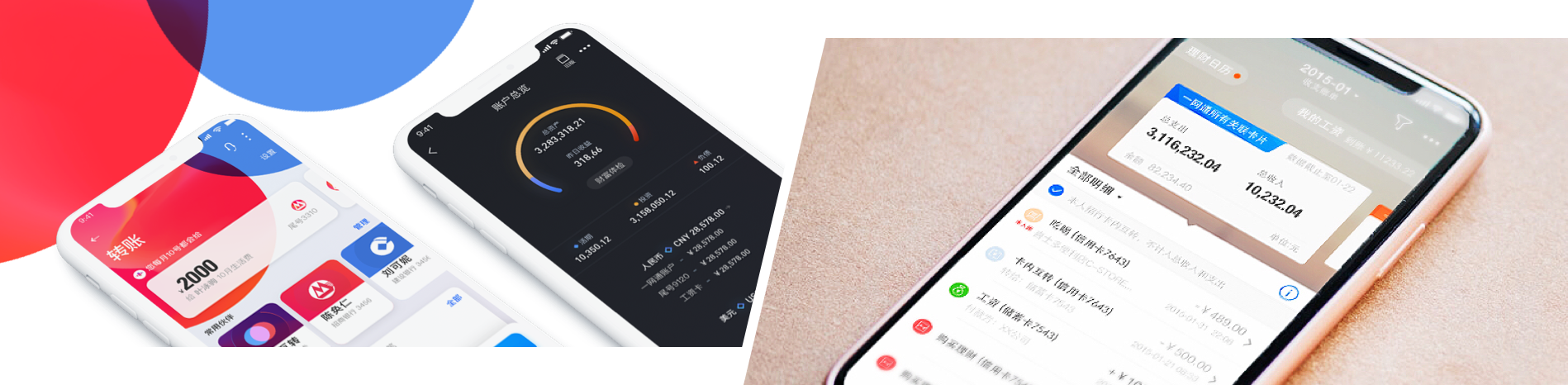

ETU has co-innovated with CMB and reached better results in personal financial service: Not only upgraded the CMB mobile banking APP from version 4.0 to 6.0, but also helped CMB maintain industry leadership by facilitating the financial experience innovation, building service system, and constructing “Digital Bank” through the service of multi-perspectives design research, including trends and insights, inclusive finance, multi-touchpoint service design, open and inclusive development, etc.

Results

As of 2017, CMB mobile banking APP has reached 100 million downloads and more than 55 million are Monthly Active Users (MAUs). The number of retail customer assets exceeded $6 trillion, reaching $6.16 trillion, up by 11.46% year-on-year. At a transaction level, mutual fund sales and income from agency fund ranked the 1st in the industry.

Insights/ Strategies

Trends and Insights: Banking and Capital Markets Outlook—competition in CMB retail banking sector

Getting an insight into industry, market, the evolution of consumer behavior, and tech development to provide valuable strategies for CMB.

1. Annual Report: Trends and Insights

CMB has always been at the forefront of change. CMB’s mobile design has always play a leading role in the mobile finance, such as CMB APP and CMB-life APP. In order to maintain their competitive positions in the marketplace and learn new things for next year, ETU would help CMB UX department conduct design trend research—include finance, temperament, latest mobile app development trends, interactive trends, user trends, etc.

2. The Financial Life of the Post-90s in China

ETU began by helping UX department of CMB retail banking to conduct audience research for different types of business journey. From the perspective of users' financial lifestyles and requirements, understand their own understanding of banks, functional requirements of mobile applications, and preferences of financial products. Then, explore the long-tail customers needs to provide innovative solutions and valuable strategies.

The Strategy of Inclusive Finance: Acquire Long-tail Customers and Deliver Business Value and Innovative Design for the Products

Fully integrate technology with customer insight according to the nature of customer needs to update and continuously provide the best customer experience.

1. Machine Gene Investment

ETU identified Chinese investors’ pain points and helped CMB establish and optimize “intelligent portfolio allocation services (PAS)” based on the mutual funds and global asset allocation. Through the real-time calculation of the investment portfolios that fulfills the customers’ needs and requirements, CMB has shared the concept of “human + machine” to increase market acceptance and trust.

Machine Gene Investment was launched in Dec 2016. From its launch until April 2018, Machine Gene Investment became the largest robot-advisor product with a total investment of more than RMB 11.2 billion.

2. Derivative

CMB not only focused its attention on the product that reached a much larger number of target customers but focused on the derivatives with a high level of customer contribution (small transaction volumes but large transaction amounts).

Closely adhering to the CMB’s strategy, ETU cooperated with CMB to establish the product framework. We solved the pain points for customers and made the operations more effective.

Multi-touchpoint Service Planning: Using Scenario in User Experience Innovation Process

Based on the user scenario, ETU diversified the CMB’s customer base and helped CMB to provide diversified services with diversified touch-points.

1. Innovative Conceptual Design

ETU has cooperated with the CMB UX department to do investigation and diagnosis on the problems annually. ETU helped the CMB to keep energetic and competitive by rethinking the design process and interaction design strategy with the trends and insights, customer requirements, and customer behaviors. CMB launched innovative services, such as “Smart Transfer” and “Professional and Rational Financial Style”.

2. Personal Income and Expenditure

Auditing is one of the most high-frequency and high-volume non-profit services. Upgrading the experience of auditing could help to create brand stickiness in products. Drew on hundreds of data points about customers to create valuable service innovation.

ETU helped CMB digital product department to establish a product framework with CMB-style. It is done to visualize and simplify the hierarchical structure of auditing. Design the strong experience of auditing with a multi-account in one record.

3. AI-based Customer Support

ETU created an operational framework for CMB’s call center and provided an FAQ template that is based on the multi-channel support as a machine learning framework to train deep neural networks and enhance model accuracy.

4. Internet Banking—Fund

After creating a great experience in designing a mobile app, CMB and ETU focused on the fund that has large transaction sales in financial products to build a multi-channel system of new finance.

ETU conducted the research to identify the pain points of internet banking users and analyze their behavior; ETU redesigned the fund channel based on a closed-loop with a well-defined sales process.

5. The Scenario-based Remote Video Assistance—VTM

To respond to the current situation, CMB has implemented IoT technology in the offline store since 2014.

With the CMB’s O2O strategy, ETU redesigned VTM and built a product specification that adapts VTM to the conditions of the indoor environment of a building. ETU helped CMB to update products and services of key business and build the identity of remote customer support to get closer to the users.

6. The Experience in the Offline Store—ATM

With the CMB’s offline marketing strategies, ETU is invited to enhance the ATM experience. ETU introduced iterative planning to acquire scenario-based innovations such as “QR code: deposit and withdrawal without card”. Through this planning, ETU helped CMB to continuously explore user needs and requirements for connecting O2O commerce by analyzing the problems of physical environment, equipment, hardware/software interface.

Open sharing: Deliver Value to the Product Operations by Resource Integration

1. Stock Exchange

ETU has sought third-party cooperation with securities firms to break down the barriers between securities products and banks. Then, ETU helped CMB to build a full spectrum of the financial services system.

2. Hong Kong Wing Lung Bank APP

The objective is to improve the business operations of Hong Kong Wing Lung Bank APP and deliver value to the scope of CMB's new finance.

ETU proposed Wing Lung Bank a strategy for enhancing the user experience on mobile APP the head office of CMB had entrusted ETU with. ETU performed rapid design iterations based on the CMB’s product specification and the Hong Kong market. ETU redesigned the mobile experience, such as the content of the stock exchange, transfer, trading, and account inquiry.

Execution