Nick Liu - Vice President of Design

2020.01.06

Nowadays, it has become the mainstream for users to obtain financial services from online channels. The new demand of users drives the bank to break through itself continuously.

ETU has experienced the rapid development of financial technology, and deeply recognized that user experience (UX) is reshaping the relationship between banks and users.

Today, We talk to Nick Liu, our Vice President of Design, about the trend of UX development in the financial industry, and how to innovate UX design in mobile banking APPs.

Looking at the Consumption of Generation Z

Q1: ETU released “Credit Future: Generation Z Credit Card Consumption Research Report” in November 2019. What interesting phenomena about Generation Z have you seen in the research?

Nick: Generation is similar to our youth, both keen on consumption, but they also have very different characteristics. For example, their consumption is driven by interests, using credit cards to buy some goods at a higher price, such as Hanfu, shoes, pets, etc.

Q2: Did the insights from Generation Z have any implications for the design of the mobile banking APPs?

Nick: Nowadays, many banks have attached great importance to improve UX. But the standard of UX is not only determined by-product experience but also driven by content and operation.

To build an excellent UX, besides the interaction design of products, the content should also respond to users’ demand, and the operation can focus on their interests, to grasp the hearts of young users.

Q3: In the cooperation with China Guangfa Bank Credit Card, is our design strategy also based on the above insights to innovate the UX of their APP?

Nick: Yes, at the beginning of the project, we found form data that elder users are more satisfied with the APP, but their repurchases rate is lower than younger users, even though younger users often complain about the experience of the APP. So we set the target audience of the APP as Generation Z users, who are fond of consuming with credit cards.

When we design the product framework and operation rules, we acquire insight that Generation Z attaches great importance to their identity recognition. Therefore, we introduced game-based design into operation rules, combing the life, interests, and dreams of young people, to respond to their emotional demands.

Q4: Why do you think understanding Generation Z is an important thing in UX design?

Nick: it’s not because Generation Z would be the main consumer in the future, so we have to study their preference. We want to discover the trend of consumer change and consumption development in the financial field from researching Generation Z.

We regard the process of understanding as new knowledge. Young people are creating their culture, so we have to communicate with them to know the direction of the future culture, and to better guide our design.

Reshaping the relationship between banks and users

Q5: In the past Double 11 shopping festival, many merchants ask me to join their online membership, what do you think about this phenomenon?

Nick: Since 2017, the market has discussed the decline of the demographic dividend. The consideration of “traffic” has gradually turned to “retention”. So enterprises began to dig the sinking market and wanted to find a new growth breakthrough.

From the perspectives of UX design, these merchants are thinking to acquire users, so that they will maintain a long-term connection with users, to achieve more orders.

Q6: How did the Membership Loyalty Experience program designed by ETU for CGB implement the above thinking?

We summarized four different systems, including Game Task System, Bonus system, User Level System, and Currency System. These four systems are interrelated, and meet the popular demand membership system in the market.

In the early stage of the project, we spent about 3 to 4 weeks on conducting inter-company interviews. We found that the main problem of the products is the bonus of members cannot be effectively perceived by users. So we finally decided to innovate the experience of the membership system.

An efficient membership system should be connected with the core business and the bonus of members. Thus, it can become a tool for communication between enterprises and users.

Constantly breakthrough in UX design

Q7: What challenges our team encountered during the project? And did the initial idea has been approved in the results?

In my opinion, there are no such things called “initial design”. The design doesn’t mean that I have a perfect idea and have to realize it. Design constraints can help us constantly optimize the design scheme.

In this project, it is very challenging to translate the insights of users into innovative solutions, because we have to consider the resource constraints of our design scheme. So we held worship with more than 20 stakeholders to listen to suggestions and verify the feasibility of these ideas from the view of enterprises.

Q8: what ETU have learned from the project?

The first harvest is to verify our methodology of Membership Loyalty Experience. We have summarized this methodology based on many years of project experience. The methodology only has value when it can be used in practice, and we are constantly optimizing it in practice.

On the other hand, the project also helps us and CGB to know more about young people, including their thinking, living habits, and consumption habits.

Redefining future financial services

Q9: ETU has been established for 16 years and has cooperated with many banks and financial institutions. As a UX designer, what changes have you experienced in the financial industry over the years?

Nick: Overall, the financial industry is paying more attention to building UX, putting UX in an important position. Even some enterprises will let UX drive product innovation, rather than using UX to package business.

UX design is not only connecting users with products but also reshaping the relationship between enterprises and users. As designers, we are no longer simply drawing, but also need to understand the value of the business.

Designers should keep empathy to design from the view of users while maximizing the business interests of enterprises. Improving the UX needs to pay attention to underlying business logic and framework as well.

Q10: The leading enterprises in the financial industry are transforming to scenario-based finance, what do you think of this phenomenon?

Our company went to Singapore in November and communicate with local colleagues. We introduce the case of domestic mobile banking APPs, but they are confused about why there are so many life services in a mobile banking APP?

In their view, life services are unrelated to the bank, and they regard the bank’s APP as a financial tool.

From my perspective, finance affects all aspects of our life. Scenario-based finance creates a closer relationship between financial business and users’ daily life, which can improve the frequency of users in the APP.

Domestic banks not only regard themselves as financial institutions but also as partners around users’ life, which I think is a great transformation.

Due to finance is closely related to our daily life so that redefining financial services as users’ partners is returning to the essence.

summary:

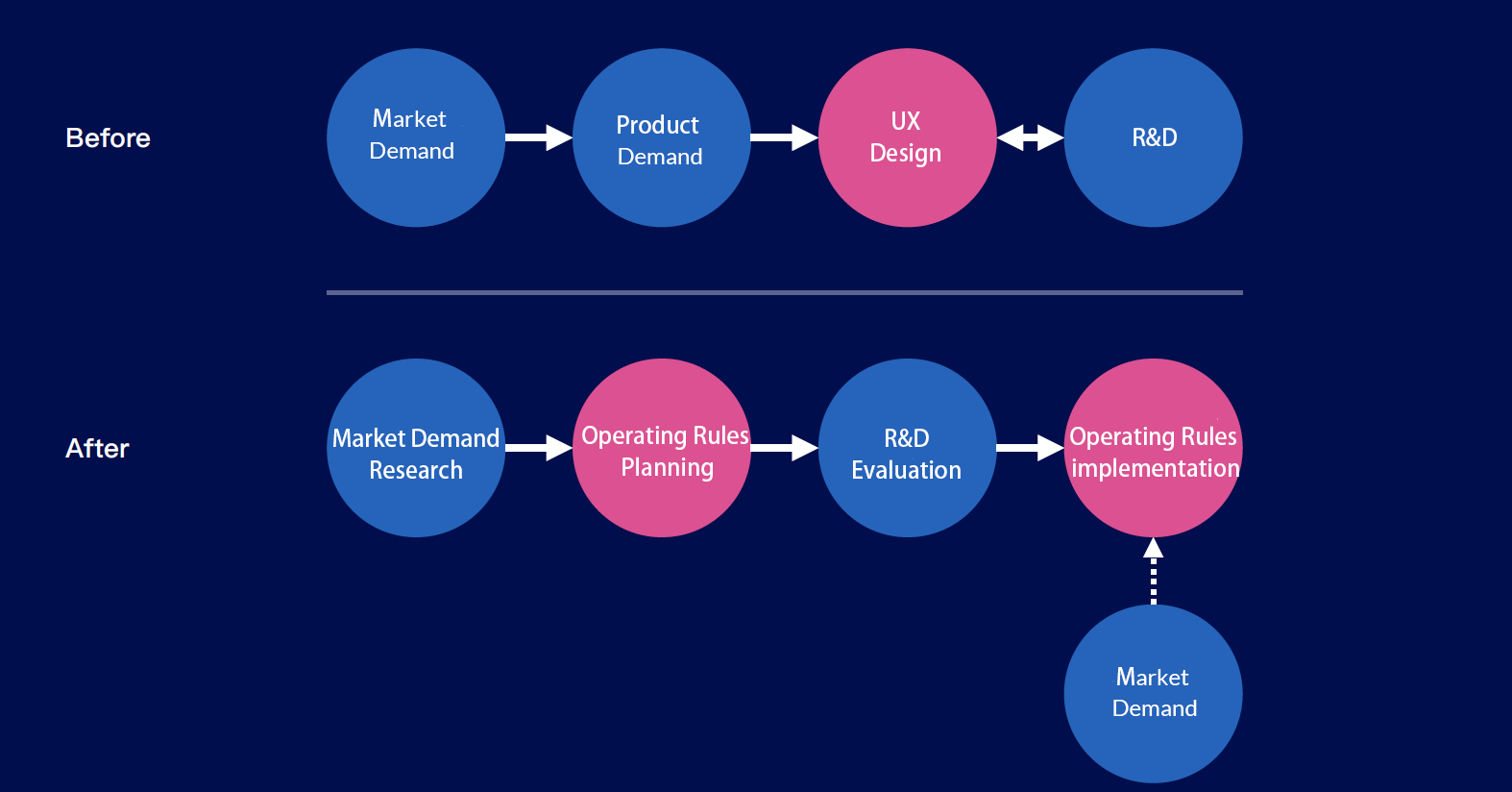

1. The current UX is no longer purely driven by product design but also determined by content, operation rules, and other business factors.

2. From Generation Z, we can see the trend of customer change and consumption development, to better understand the future direction of social development.

3. An efficient membership system should think about the core business, membership bonus and user interaction, to build a closed-loop communication between corporations and users.

4. Finance is closely related to daily life, and banks can be closer to users’ life consumption and improve the frequency of users in their APPs from the perspective of scenario-based finance.